Range trading is a popular strategy utilized by financial traders to profit from price fluctuations within a defined range. By identifying key support and resistance levels, traders can strategically enter and exit trades, capitalizing on the market’s oscillations. In this comprehensive guide, we will delve into the intricacies of range trading.

Range trading strategy involves identifying a range-bound market where prices move between well-established support and resistance levels. Traders aim to buy near the lower boundary and sell near the upper boundary, anticipating reversals at these levels. By focusing on short-term price fluctuations, range trading allows traders to potentially capitalize on the historical patterns formed from market behavior. However, it is important to remember that range trading is most effective in sideways or consolidating markets, where price trends are limited.

Range trading strategy offers a structured approach, defined risk and reward parameters, reduced exposure to market volatility, and the versatility to be applied across various financial markets. Moreover, range trading emphasizes clear technical levels, instills discipline through its structured approach, and promotes effective risk management techniques.

To effectively implement a range trading strategy, traders must consider several key elements that will enhance their trading approach and potential for success:

The first step in range trading is identifying the range itself. Traders rely on technical analysis tools, such as trend lines, moving averages, and indicators, to determine the upper and lower boundaries of the range. These boundaries represent the levels where the price tends to oscillate, providing traders with a clear framework for their trading decisions.

Once the range is identified, traders need to establish precise entry and exit points within the range. This step is crucial for effectively capitalizing on price reversals and maximizing profit potential. By setting specific entry points near the support level for buying and the resistance level for selling, traders position themselves to enter the market at historically key points and take advantage of price movements within the range. Similarly, determining precise exit points helps traders secure profits before the price reaches the opposite boundary of the range.

Risk management plays a pivotal role in range trading strategy. Traders must protect their positions and limit potential losses in case the price breaks out of the range. This is achieved through the use of stop-loss orders, which are strategically placed below the support level for buying and above the resistance level for selling. By setting stop-loss orders, traders define the maximum acceptable loss for each trade and ensure that their risk exposure remains controlled.

There are numerous range trading strategies that traders employ in financial markets. Traders often combine multiple strategies or develop their own customized approaches based on their trading style, risk tolerance, and market conditions. Here are some common range trading strategies:

Channels can be vital tools to guide trading decisions. These are based on support and resistance levels identified from historical price action and represent areas where buying and selling pressure have previously converged. A channel is formed when there is a pair of clear support and resistance lines that are parallel to each other, showing that the trading is range bound.

Support levels act as price floors, where demand exceeds supply, leading to a potential price rebound. Buying near support levels allows traders to potentially benefit from price bounces and capitalize on potential upward movements in the market. On the other hand, resistance levels act as price ceilings, where supply surpasses demand, often resulting in a potential price reversal or pullback. Selling near resistance levels enables traders to potentially profit from downward price movements or take advantage of potential market reversals.

The Bollinger Bands trading strategy is a widely employed method that utilizes a volatility indicator to analyze market conditions. Bollinger Bands consist of three key components: an upper band, a lower band, and a moving average that lies between them. The upper and lower bands dynamically adjust based on market volatility, expanding or contracting accordingly.

Traders employing this strategy observe the price action in relation to these bands. When the price reaches the lower band, indicating potential oversold conditions, traders consider it a signal to buy. Conversely, when the price reaches the upper band, indicating potential overbought conditions, traders view it as an opportunity to sell. The Bollinger Bands strategy allows traders to gauge the market’s volatility and identify potential entry and exit points based on the price’s relationship with the bands.

The breakout strategy is a widely employed technique by traders seeking to take advantage of potential price movements in the market. Traders implementing this strategy carefully observe range-bound markets, characterized by prices moving within a defined range, and eagerly await a breakout.

A breakout occurs when the price surpasses a specific level of resistance on the upside or breaches a particular level of support on the downside. By identifying these critical levels and strategically entering trades upon their breakout, traders aim to capitalize on the ensuing price momentum. This strategy acknowledges that when the price breaks free from the constraints of a range-bound market, it often signifies a shift in market sentiment and the possibility of a new trend emerging. Successful implementation of the breakout strategy requires careful analysis of historical price patterns, the consideration of relevant indicators, and proper risk management to maximize potential gains while minimizing losses.

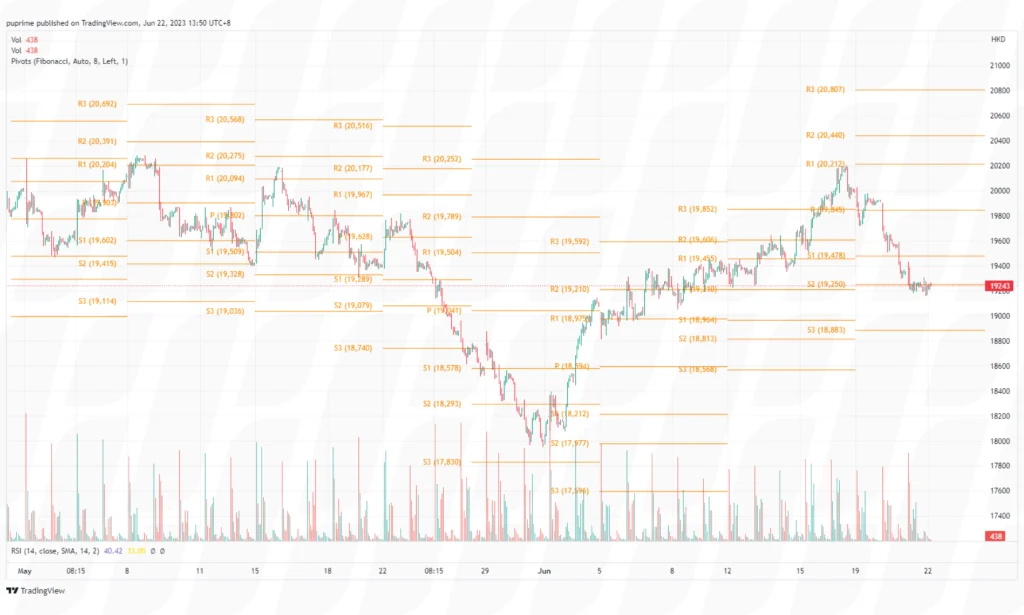

The pivot point strategy is a popular tool utilized by traders to determine potential support and resistance levels in the market. Traders rely on pivot points, which are calculated using the previous day’s price action, to identify these critical levels. Support represents a price level where buying interest is expected to emerge, while resistance represents a level where selling pressure may intensify. Because the pivot point is an intraday indicator, day traders use it to define ranges in which to trade in.

Traders employing the pivot point strategy aim to buy near support levels, anticipating a potential bounce in price, and sell near resistance levels, anticipating a possible price reversal or pullback.

Instead of using fixed time intervals, the range bar strategy is a unique approach employed by traders to analyze price movements in the market. Unlike traditional methods that rely on fixed time intervals, the range bars strategy utilizes bars that are constructed based on price movement. Each range bar represents a specific price range, and the length of the bar is determined by the range set by the trader.

By using range bars, traders aim to capture and analyze the essence of price volatility and momentum. They enter trades when the price action reaches the extremes of the range bars, indicating potential areas of support or resistance. This strategy allows traders to adapt to changing market conditions and focus on the significance of price movements rather than the passage of time. The range bars strategy requires traders to identify appropriate range settings based on the specific market they are trading, select relevant indicators to support their analysis, and effectively manage risk to optimize trading outcomes.

Range trading offers several advantages, including the ability to profit from short-term price oscillations and a structured approach that suits traders who prefer defined boundaries. However, it is important to recognize its limitations. Range trading works best in sideways markets, and when markets transition into trending phases, it may result in missed opportunities. Traders must be vigilant and prepared to adjust their strategy when market conditions change.

Range trading strategy provides traders with a systematic approach to capitalize on price movements within a defined range. By identifying support and resistance levels, setting precise entry and exit points, and implementing effective risk management, traders can take advantage of repetitive market behavior. However, it is crucial to remember that range trading may not be suitable in all market conditions, and continuous monitoring and adaptation are necessary to stay ahead of potential breakouts. By mastering the range trading strategy and adhering to sound trading principles, traders can enhance their chances of success in the financial markets.

以行业低点差和闪电般的执行速度交易外汇、指数、贵金属等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!