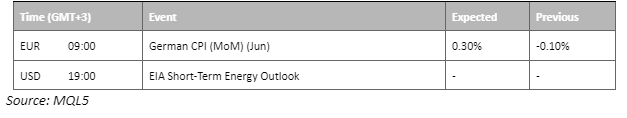

The US Dollar has strengthened significantly as economic data exceeded expectations, bolstering confidence in the currency. Furthermore, the robust performance of the banking sector has ignited positive momentum in the US equity market. The Federal Reserve’s stress test results have demonstrated the resilience of major banks such as Wells Fargo, JPMorgan Chase, and Goldman Sachs. In addition, encouraging signs in the form of robust GDP growth and a decline in the number of Americans filing for unemployment benefits have underscored the vitality of the US economy. Crude oil prices have experienced a surge following a substantial reduction in US crude stocks, indicating strong demand. Moreover, recent data from the US PCE index has shown a moderation in the inflation rate, aligning with a similar trend in the Eurozone, where the CPI dropped to 5.5% from the previous reading of 6.1%.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (11%) VS 25 bps (89%)

The US Dollar slumped over the backdrop against downbeat inflation data. In May, US consumer spending experienced a significant deceleration, resulting in a slight easing of inflation pressures, as revealed in a recent Commerce Department report. The index, registered at 4.6%, slightly lower than market expectations of 4.70%. This data suggests that consumer demand may be cooling off, thereby alleviating concerns about excessive inflationary pressures in the economy.

The dollar index is trading lower while currently testing the support level at 102.75. MACD has illustrated increasing bearish momentum, while RSI is at 50, suggesting the index might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 103.35, 103.90

Support level: 102.75, 102.00

Gold prices have experienced a sharp rise as the US Dollar depreciates, driven by reduced expectations of imminent rate hikes. The latest PCE index indicating lower-than-expected inflation levels has dampened rate hike expectations, leading to a significant decline in the US Dollar’s value. As a result, investors have turned to gold as a safe-haven asset, propelling its prices higher.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 63, suggesting the commodity might be traded lower in short-term as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 1920.00, 1930.00

Support level: 1910.00, 1895.00

The dollar’s strength seesawed for the last few sessions and investors are waiting for the FOMC meeting minutes to gauge the strength of the dollar. Last week, the U.S. economic data showed that the country’s economy is robust; conversely, the PCE index showed that the inflation rate in the U.S. is moderating and both factors fluctuate the dollar index. In contrast, the euro’s CPI dropping to 5.5% from its previous reading of 6.1% is challenging the hawkish monetary policy from the ECB.

EUR/USD successfully rebounded on its crucial support level at 1.0848 while forming a lower-high suggesting a bearish signal for the pair. The RSI continues to flow in the lower region while the MACD has a bullish cross at the bottom.

Resistance level: 1.0951, 1.1027

Support level: 1.0892, 1.0848

The Japanese yen has seen a modest strengthening against the US Dollar, with investors closely monitoring the possibility of intervention by the Bank of Japan (BoJ). Warnings from Japan’s Finance Minister and other officials against excessive yen weakening have fueled market anticipation of potential central bank actions. As for now, investors would closely watch for any signs of intervention, contributing to the yen’s recent strengthening.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the pair might enter overbought territory.

Resistance level: 145.35, 150.15

Support level: 141.60, 138.95

The recent economic data does not favour the Sterling, with the GDP (YoY) dropping to 0.2% from 0.6% last reading. Notwithstanding the pessimistic economic data, the BoE continued to release hawkish statements which supported the Sterling to stay above 1.26 against the USD. On the other hand; the U.S. PCE index also showed that the inflation rate in the U.S. has signs of moderating which hampers the dollar’s strength as the market speculates that the Fed may start to cut its rate this year.

GBP/USD has rebounded to its previous psychological support level of 1.2700. The RSI has rebounded before getting into the oversold zone, while the MACD has crossed below the zero line suggesting a trend reversal.

Resistance level: 1.2775, 1.2840

Support level: 1.2630, 1.2540

The US equity market managed to edge higher despite the release of a downbeat inflation report, which prompted a rise in US Treasury yields. However, with the US holidays today, market movements are expected to be relatively flat. Looking ahead, market participants are eagerly awaiting the release of the FOMC meeting minutes and Nonfarm Payroll reports later in the week, as these events will provide crucial trading signals and shape investor sentiment.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 34835.00, 35475.00

Support level: 34210.00, 33685.00

In response to softer US inflation data, oil prices experienced an upward trajectory as investors began to speculate that the Federal Reserve may adopt a more restrained approach in its hawkish monetary policy stance. On the other hand, the OPEC+ alliance has implemented a series of three production cuts since October 2022, aimed at reducing global oil supply by an estimated 2.5 million barrels per day. As a result, their production levels are projected to reach approximately 9 million daily barrels in July. However, despite these efforts, the overall outlook for oil remains uncertain, with investors grappling to assess whether the impact of potential Fed rate hikes or the production cuts will exert a greater influence on market dynamics.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum. On the other hand, RSI is at 57, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 70.70, 74.20

Support level: 67.20, 65.00

以行业低点差和闪电般的执行速度交易外汇、指数、贵金属等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!