Chinese stock indices, including the Hang Seng Index, rallied as Alibaba said it would split the company into 6 units that would potentially be listed individually. This reflects a loosening attitude from the Chinese government toward the technology companies after the long crackdown from Beijing. On the other hand, the fresh Australian CPI showed a deceleration in Australian inflation in February; this may increase the likelihood for the RBA to discuss a pause in the monetary tightening program next week. In addition, oil prices continue to advance this week after the resolving of the banking crisis and the intensified geopolitical tension in the Euro; oil prices are further stimulated by the significant drop in crude oil stockpile, with the API report showing a significant drop in crude oil inventories reflecting strong demand in the U.S. Elsewhere, gaining bond yields in the Eurozone and the U.S, reflect the increasing confidence of investors toward the markets.

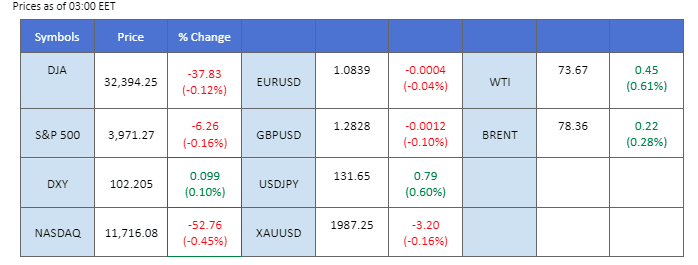

Current rate hike bets on 3rd May Fed interest rate decision:

0 bps (58.8%) VS 25 bps (41.2%)

The US Dollar Index continued its decline for a second consecutive day against a basket of major currencies. Investors’ appetite for riskier currencies improved amid signs of easing concerns over a banking crisis. The market is now looking forward to the US inflation data, scheduled to be released later this week, which is expected to provide further trading signals.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the index to extend its losses in short-term.

Resistance level: 102.85, 103.50

Support level: 101.95, 100.85

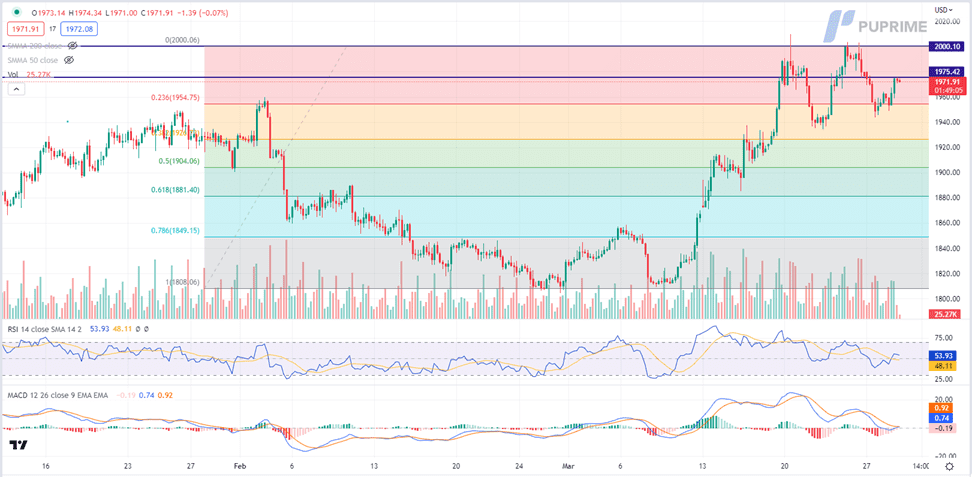

Gold prices rebounded significantly from a crucial support level on Tuesday as market participants entered the gold market for bargain hunting. The lower US Dollar also made gold prices more attractive as an alternative investment. As investors shift their attention to US economic data, Friday’s personal consumption and expenditures (PCE) data will be a key highlight. This report is expected to provide fresh clues on inflation and will likely affect monetary policy decisions from the Federal Reserve.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 54, suggesting the commodity might extend its gains after breakout since the RSI is above the midline.

Resistance level: 1975.00, 2000.00

Support level: 1955.00, 1925.00

Market shift focuses away from the dollar after signs that the banking crisis is easing. The dollar continues to weaken and trade below $103. investors have increased risk-on sentiment in the market with the reassurance from policymakers and major central banks that there would not be a banking crisis. On the other hand, the Euro bond yield has been gaining, reflecting a restoration in confidence in Euro economies pushing the euro to trade higher against the dollar abreast with the Hawkish tone from the ECB. In addition, the U.S. PCE economic data is set to be released this Friday (31st March); the key measure of inflation focused by the Fed may impact the dollar index’s price movement.

The indicators depict a bullish bias for the pair with a slowdown in momentum. The RSI is moving toward the overbought zone while the MACD has a sign of rebound before breaking below the zero line.

Resistance level: 1.0867, 1.0917

Support level: 1.0698, 1.0613

The Australian Dollar, often viewed as a liquid proxy for risk appetite, gained 0.77% due to better-than-anticipated retail sales data. The Australian Bureau of Statistics reported that retail sales for the previous month surpassed market expectations, rising by 0.20% compared to the forecasted 0.10%. This impressive performance provided a significant boost to the Australian Dollar. Nonetheless, the gains experienced by the Aussie are still limited by an easing inflation report. According to the Australian Statistician, Consumer Price Index (CPI) from Australia came in at 6.8%, lower than the market expectations of 7.10%.

AUDUSD is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 59, suggesting the pair might trade lower as technical correction.

Resistance level: 0.6720, 0.6780

Support level: 0.6640, 0.6580

The Pound Sterling edges higher 0.29% to $1.2327 after the BoE said there was no tension in the U.K. banking system. The BoE Governor Andrew Bailey told parliament’s Treasury Committee that the central bank was on alert amid global turmoil in the banking sector. After the banking crisis in recent weeks, top U.S. banking regulators plan to tell Congress that the overall financial system remains on solid footing, and they will comprehensively review their policies to prevent future collapses. On the data front, the U.K.’s grocery inflation rose again in March to a record of 17.5%, inflicting more pain on consumers battling a cost-of-living crisis. Furthermore, the BoE raised 25 bsp to 4.25% last week and said the resurgence in inflation would fade fast, prompting speculation had ended its run of hikes. In addition, investors can keep an eye on the upcoming UK GDP data, which will be released on Friday, for further trading signals.

The pound seems to stand firm above $1.2298, and we could expect the trend to continue moving upward. MACD has illustrated bullish momentum ahead. RSI is at 59, indicating the pound is trading in a bullish momentum in the short term.

Resistance level: 1.2425, 1.2613

Support level: 1.2298, 1.2190

The Dow Jones Index fell 0.12% to 32,394 points on Tuesday as investors weighed comments from a top U.S. regulator on struggling banks and sold technology shares after their recent strong run. Shares of Apple (APPL.O) and Microsoft (MSFT.O), along with other technology-related stocks, ended lower as potential profit-taking. Banking stocks have sold off sharply due to problems at Silicon Valley and other banks. Moreover, the prospect of stricter regulations for banks with deposits above $100 billion is raising the anxiety level for those that are perceived currently to be struggling. as for now, and investors are looking forward to the upcoming bank results, which may give more clues about the health of the banking sector.

The Dow is trading near the resistance level at 32545 points as of writing. MACD has illustrated increasing bullish momentum ahead. RSI is at 52, indicating a neutral-bullish momentum ahead.

Resistance level: 32545, 34308

Support level: 30945, 28760

Oil prices continued to gain ground on Tuesday, building on their bullish momentum as investors remained focused on supply disruption risks from Iraqi Kurdistan. The recent halt of exports of around 450,000 barrels per day (bpd) from the region through Turkey has caused market concerns and prompted a surge in oil prices. In addition, China National Petroleum Corp’s forecast that Chinese crude oil imports are expected to rise by 6.2% in 2023 to 540 million barrels has also supported the bullish outlook for oil prices. In addition, the latest data from the American Petroleum Institute (API) showed that weekly crude oil stocks declined significantly by 6.076 million barrels, a sharp contrast to market expectations of a 0.187-million-barrel increment.

Oil prices are trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the commodity might enter overbought territory.

Resistance level: 73.80, 77.25

Support level: 68.60, 64.75

以行业低点差和闪电般的执行速度交易外汇、指数、贵金属等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!